Fast, simple underwriting software for life

insurance agents.

Our AI saves you time and boosts your bottom line. See more clients. Close more deals.

Underwriting life insurance is hard.

We make it easier.

Ditch your cheat sheets

Make more accurate recommendations

Best Plan Pro users save time and place15% more business.

Automatically pre-qualify your clients for Term, Final Expense, and Whole Life insurance products using AI.

Get a quote in 3 easy steps.

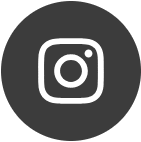

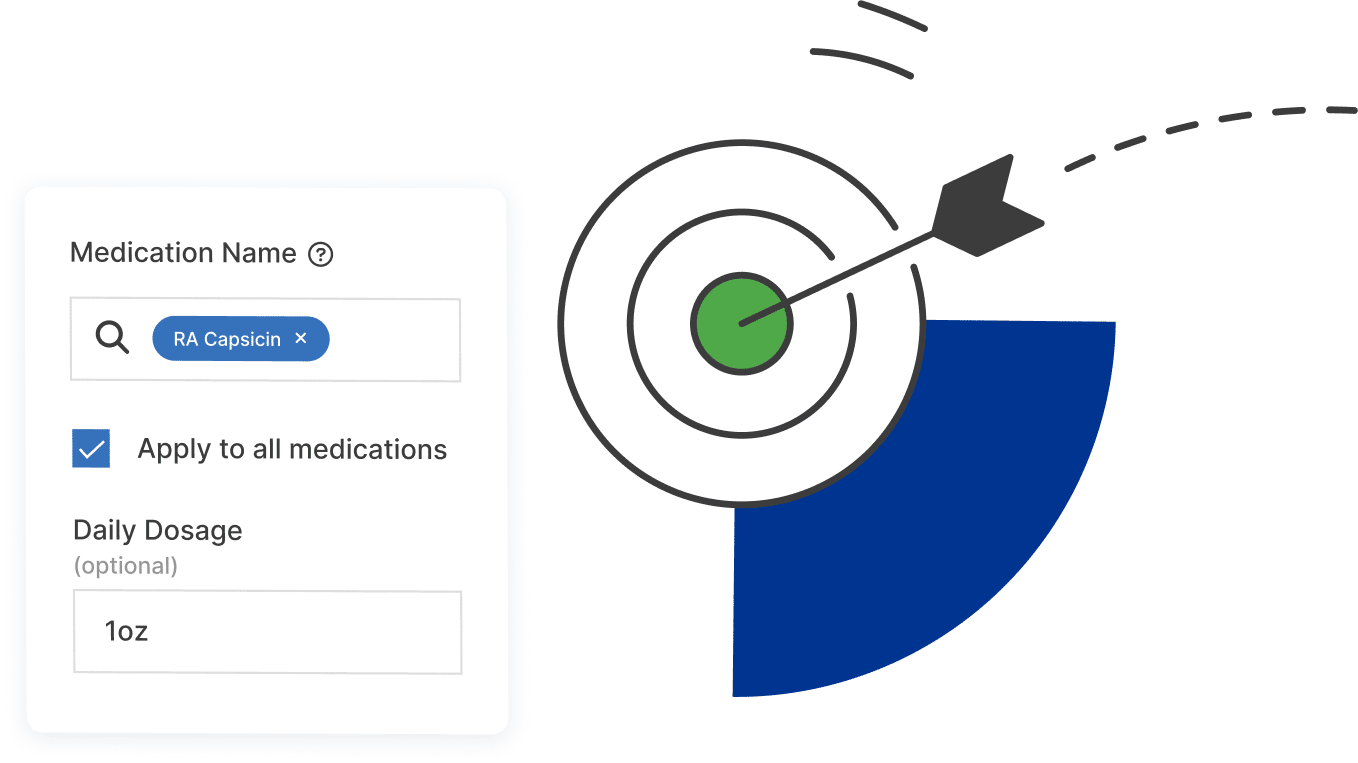

Step 1: Enter Your Client’s Information

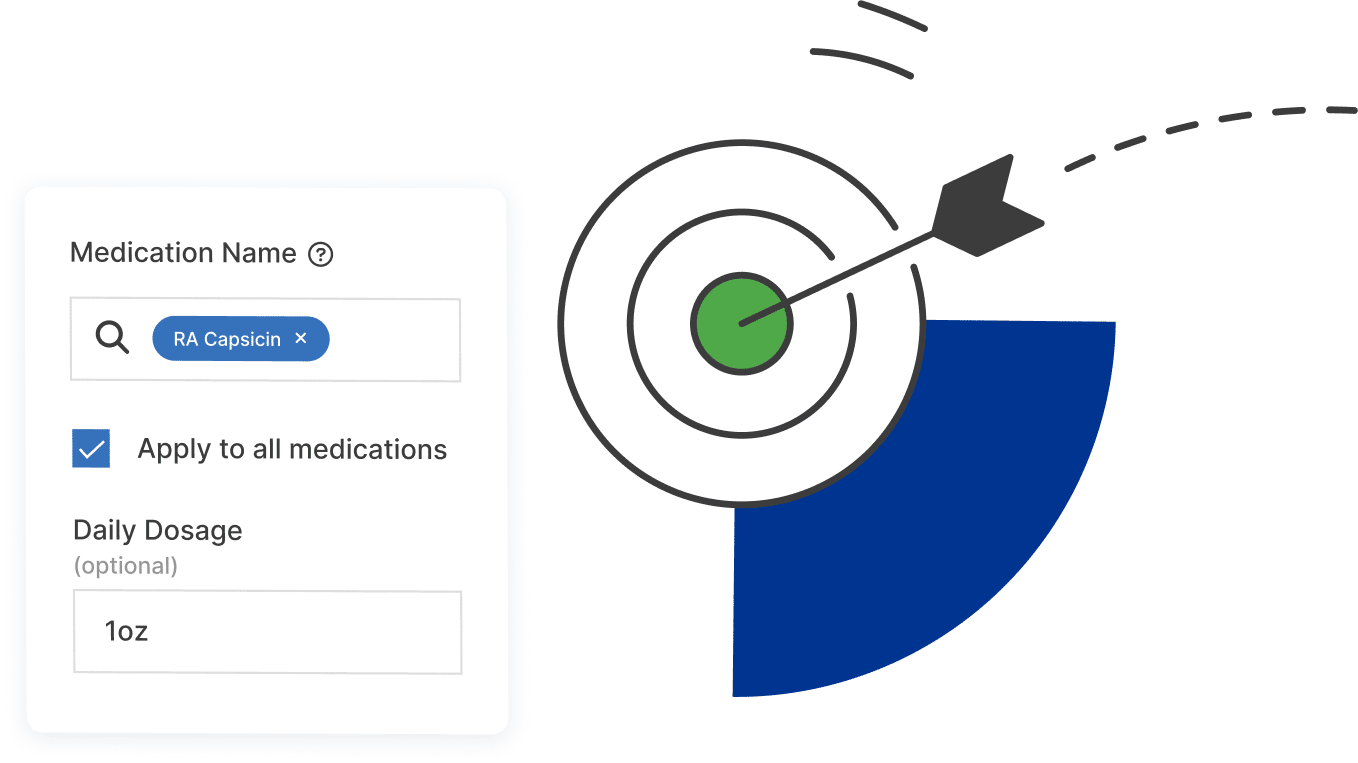

Our AI makes data entry easy with automatic abbreviation support, typo correction, and intuitive search.

Step 2: Choose Product Types

Select FEX, Term, MedSup, or Preneed coverage options and enter your client’s budget.

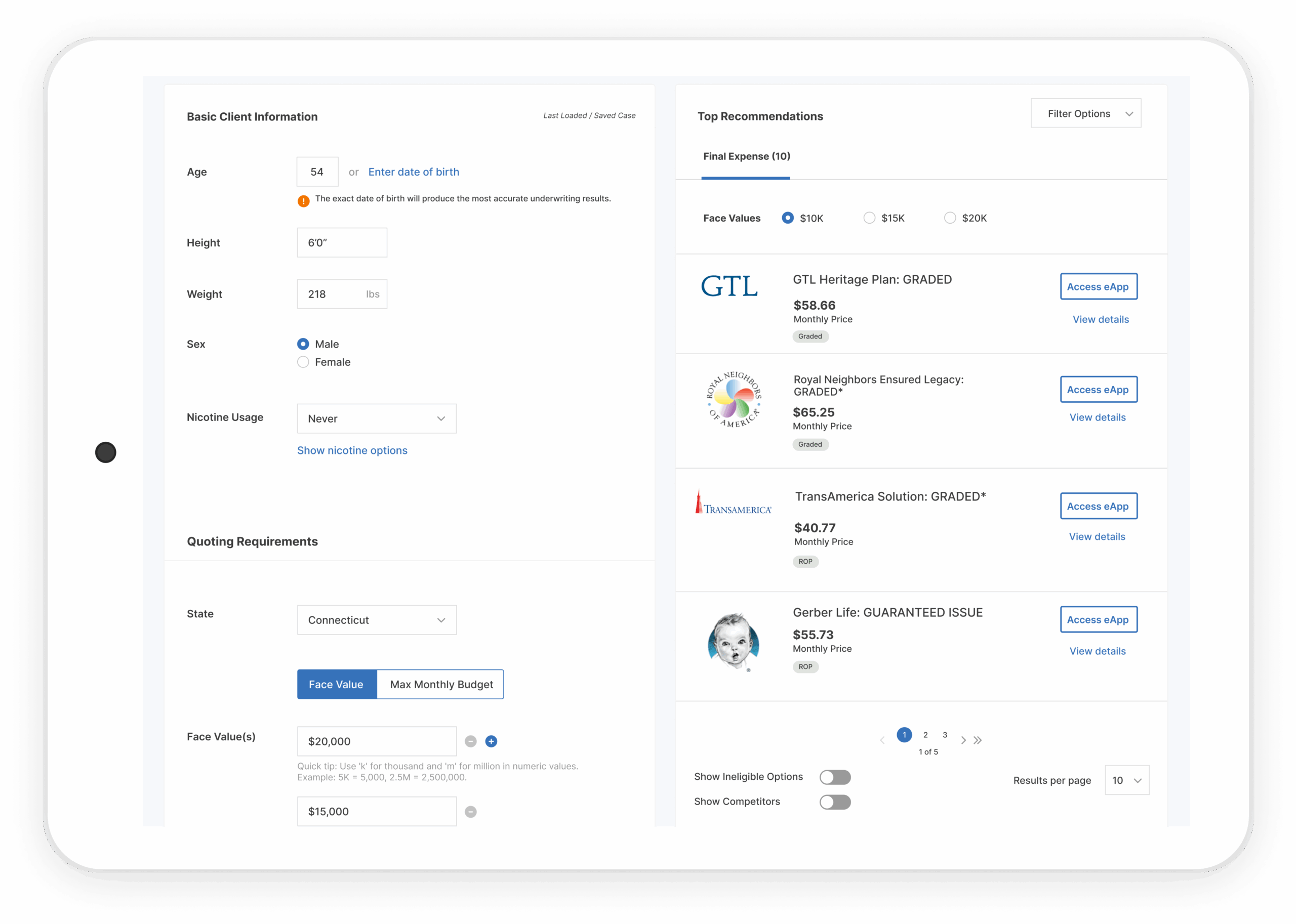

Step 3: Run a Quote and Make a Recommendation

Our software helps agents make accurate recommendations across insurance companies and products.

Pricing Plans

Individual Agents

$29.99/mo

15-minute setup

What customers say about Best Plan Pro

“If you’re doing business in the Final Expense, Life Insurance market and you’re not using Best Plan Pro, you are making a very big mistake.”

David Paul

Director of Simplified Issue Life AmeriLife

“Best Plan Pro is simply the best underwriting software available to independent agents.”

David Duford

Duford Insurance Group

“One of the best resources in the insurance space to help agents underwrite and know what option is best for the client.”

Marques Pagan

Life Insurance Agent